The W8ben Form Cmc is a specialized tax form designed for non-US residents to certify their foreign status and to simplify withholding on certain US-sourced payments. This guide explains what the W8ben Form Cmc is, how it differs from other W-8 forms, and practical steps to complete and file it accurately.

Key Points

- The purpose of W8ben Form Cmc is to establish foreign status for tax withholding purposes and to outline eligibility for treaty-based reductions.

- It covers individuals and entities that receive passive US income and aims to prevent excessive withholding.

- Accurate personal or entity information helps avoid delays and requests for further documentation.

- Timely submission matters because late forms can result in default higher withholding rates until the form is approved.

- It often expires or needs renewal, so tracking its validity is part of ongoing tax compliance.

What is W8ben Form Cmc?

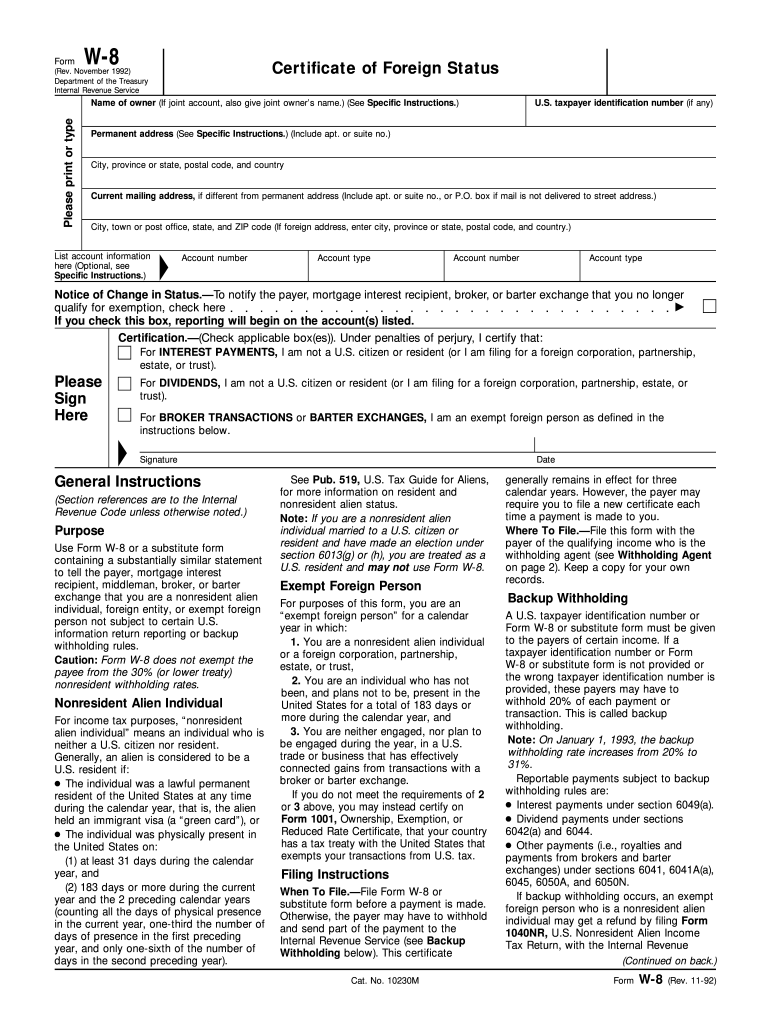

W8ben Form Cmc is a variant of the standard W-8BEN used by non-US residents to certify foreign status and, when applicable, claim reduced withholding under an applicable tax treaty. The “Cmc” designation may indicate a specific filing stream, program, or jurisdiction within a broader framework. The form collects essential information such as name, country of residence, permanent address, and identification details, and it requires an accurate signature to confirm authenticity.

Who should file W8ben Form Cmc?

Anyone who receives US-source passive income and is not a US citizen or resident for tax purposes should determine whether W8ben Form Cmc applies. This includes individuals, corporations, partnerships, and other entities that may benefit from treaty provisions or reduced withholding. Before filing, gather documentation that supports residency, treaty eligibility, and identity to ensure a smooth submission.

How to fill out W8ben Form Cmc

The process involves collecting accurate information, selecting the correct foreign-status box, and signing under penalties of perjury. Be precise about your name, country of residence, permanent address, and (where required) a foreign tax identification number. If you rely on treaty benefits, clearly indicate the applicable treaty article and rate. Review the form for consistency with supporting documents to avoid delays. Accuracy and consistency are your best allies here.

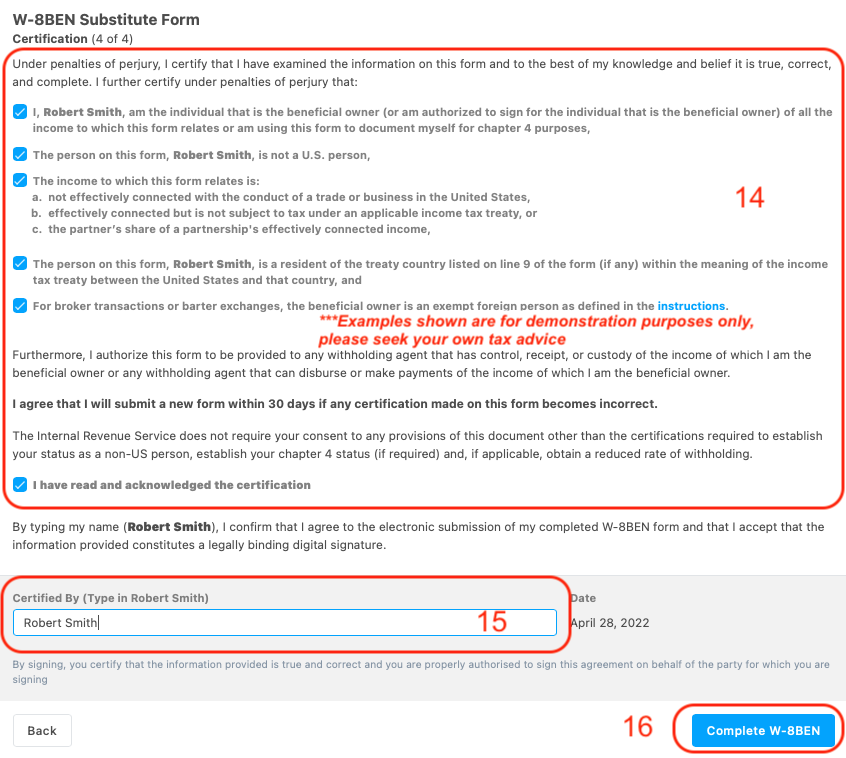

Step-by-step guide

Step 1: Gather personal information such as your full legal name, country of residence, and current address.

Step 2: Determine if you qualify for any treaty benefits and identify the correct article and rate to apply.

Step 3: Complete the form data accurately in the designated fields and prepare any required supporting documents.

Step 4: Sign and date the form, and submit it to the payer or withholding agent as instructed. Keep copies for your records.

What is the main purpose of the W8ben Form Cmc?

+The main purpose of W8ben Form Cmc is to certify foreign status for US withholding purposes and to enable eligibility for treaty-based reductions on US-sourced income. It is not a substitute for a tax return but a tool to establish eligibility for reduced withholding when applicable.

<div class="faq-item">

<div class="faq-question">

<h3>Who should file the W8ben Form Cmc?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>People or entities that receive US-source passive income and are not US citizens or residents typically file this form. It applies to individuals, corporations, partnerships, and other entities that may benefit from reduced withholding under a tax treaty.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What information is required on the form?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Typically you’ll provide your name, country of residence, permanent address, and identifying numbers as applicable. If you claim treaty benefits, you’ll indicate the treaty article and the reduced withholding rate on the form, supported by documentation as needed.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What happens after submission?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>The payer or withholding agent reviews the form and any supporting documents. If approved, the withholding rate is adjusted accordingly. If additional information is needed, you may receive a request for clarification or more documents.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How long is the W8ben Form Cmc valid?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Typically, the form remains valid for the year of filing and may need to be renewed if treaty terms change or the payer requires updated information. Always monitor expiration dates and renew before they lapse to avoid withholding changes.</p>

</div>

</div>